Neighborhood National Bank

Empower your business with the right financial support.

Neighborhood National Bank reported net income of $3.8 million and 30% growth in total assets to $226 million

San Diego, February 12, 2026—Neighborhood National Bank (NNB), the only bank CDFI in San Diego County reported record earnings, record growth and record new loan originations in 2025. Neighborhood generated operating profit of $1.3 million, also a record for the Bank, and based on its strong performance was able to realize a tax credit of $2.5 million in 2025. Neighborhood continues to support small-to-medium sized businesses in low and moderate-income communities, primarily in South and East San Diego County, fulfilling its primary CDFI mission.

“In 2025 NNB achieved significant growth and profitability due to the hard work and dedication of its experienced team of bankers” said Scott Andrews, President & CEO. “We continue to focus on our CDFI mission, which dates back to the Bank’s founding in 1997 by supporting local non-profit agencies and churches, providing financial services in low and moderate-income neighborhoods, and supporting important local events. Neighborhood National Bank’s staff is dedicated to doing good and giving back to the communities we serve.”

The record earnings in 2025 is a direct result of consistent growth over the past three years, including the addition of a loan production office in Orange County. The Bank maintains outstanding asset quality, and deposit growth has also been solid due to new customer acquisition. “Neighborhood National Bank is the only community bank serving South San Diego County, and we are focused on building community engagement and supporting businesses in low and moderate-income communities that are often neglected by national and regional banks” said Melyn Acasio, NNB’s Community Development Officer. Acasio is a National City native and has spent her entire banking career in San Diego County serving the local community. The Bank will be opening a new full-service branch in National City in the near future to further support its CDFI mission of providing banking services in low and moderate-income communities.

About Neighborhood National Bank

Neighborhood National Bank is a nationally- chartered, federally insured bank serving the broader San Diego region since 1997. As the oldest community bank in San Diego, Neighborhood National Bank was founded on the premise of being a good neighbor – a promise it upholds today by providing affordable, flexible, and accessible financial products to individuals, small businesses, and nonprofits across San Diego County. Neighborhood National Bank is a certified community development financial institution (CDFI), reflecting its commitment to serving low- and moderate-income San Diegans and investing in local small businesses, affordable housing, and nonprofits.

Member FDIC

Financial Calculators

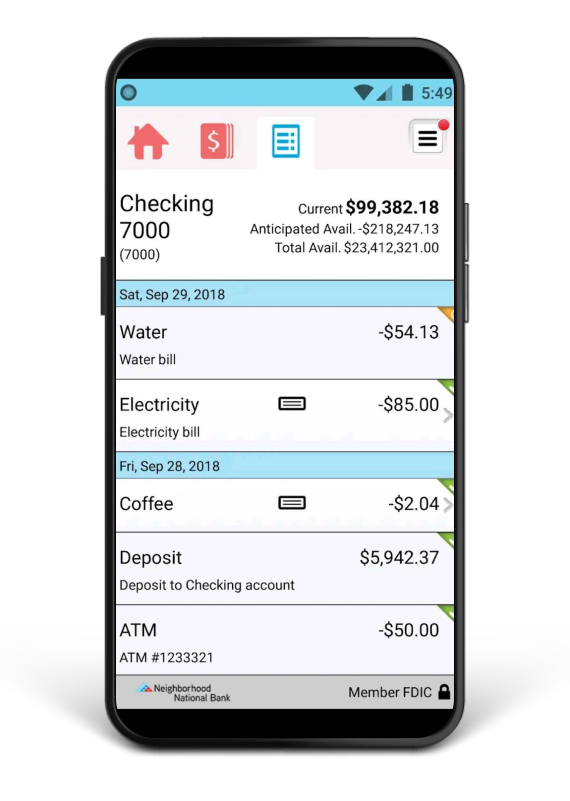

Banking on the go? Our mobile app has you covered.

Stay up to date with us!

Connect with us.

Thank you.

Personal Checking

Business Checking